The Digital Panopticon - A Call for Emancipation

In the 21st century, we find ourselves unwitting residents of a digital panopticon, our every move, preference, and interaction meticulously tracked, analyzed, and monetized.

This erosion of digital autonomy, driven by what Shoshana Zuboff termed “surveillance capitalism,” presents an existential threat to individual freedom and collective democracy. As centralized digital platforms amass unprecedented power, the promise of the internet as a tool for liberation and empowerment seems increasingly distant.

Surveillance Capitalism: The Invisible Chains of the Digital Age

The current digital paradigm operates on a simple yet insidious principle: our personal data is the new oil, and tech giants are the new robber barons. This system poses several critical challenges to individual autonomy:

-

Data Exploitation: Personal information is harvested at an industrial scale, often without meaningful consent or comprehension from users.

-

Behavioral Manipulation: Sophisticated algorithms shape our choices, potentially limiting our free will and creating echo chambers that polarize society.

-

Digital Centralization: Power concentrates in the hands of a few tech giants, reducing individual control over digital experiences and stifling innovation.

Crypto’s Promise and Pitfalls: A Critical Examination

Cryptocurrency and blockchain technology emerged as potential antidotes to this digital dystopia, promising a decentralized future where individuals retain control over their data and digital interactions. However, the reality has often fallen short of this vision:

-

Centralization Creep: Many blockchain projects have succumbed to the very centralization they sought to combat, with power concentrating in the hands of large mining pools, exchanges, and influential figures.

-

Regulatory Challenges: The response of traditional financial regulators has often been heavy-handed, threatening to stifle innovation in the name of consumer protection.

-

Usability Hurdles: The complexity of many decentralized solutions has limited their adoption, allowing centralized alternatives to maintain their dominance..

Crypto vs. Establishment: The Crusade of Financial Innovation

The journey of crypto has been marked by constant friction with established power structures, echoing historical patterns of resistance to financial innovation. This struggle is not unique to our digital age but has deep roots in the annals of history.

A compelling historical parallel can be drawn with the Knights Templar in the 12th and 13th centuries:

-

Early Banking Innovations: The Knights Templar developed one of the earliest systems of banking in medieval Europe. They introduced credit notes that allowed pilgrims to deposit funds in one location and withdraw them in another, a revolutionary concept for its time.

-

Challenging Established Financial Orders: This system challenged the financial status quo, much like how cryptocurrency challenges traditional banking today. The Templars’ financial innovations provided alternatives to the established monetary systems controlled by monarchs and the Church.

-

Resistance from Power Structures: The Templars’ financial power eventually led to their suppression in 1307, partly motivated by the French monarchy’s financial interests. This echoes modern attempts by some governments and financial institutions to control or suppress cryptocurrency innovations.

-

Legacy of Financial Innovation: Despite their suppression, the Templars’ banking practices laid groundwork for modern financial systems and fractional reserve banking. Similarly, regardless of regulatory challenges, the innovations brought by cryptocurrency are likely to have lasting impacts on global finance.

The push for financial innovation and the resistance from established powers have deep historical roots. It underscores the importance of Koii’s mission to create decentralized systems that are resilient against centralized control and suppression.

Modern Manifestations of Resistance

In the crypto era, this age-old tension between innovation and established power manifests in several ways:

-

Banking Blockades: Early crypto companies faced account closures and payment processing challenges, spurring the development of decentralized financial tools. This modern-day financial exclusion echoes historical attempts to control monetary systems.

-

Media Manipulation: Mainstream media’s often negative portrayal of crypto led to the growth of community-driven information channels and decentralized media platforms. This struggle for narrative control mirrors historical efforts to shape public perception of financial innovations.

-

Regulatory Whack-a-Mole: As regulators in some jurisdictions cracked down, the crypto community demonstrated its resilience by shifting and adapting, highlighting the antifragile nature of decentralized systems. This adaptability is reminiscent of how financial innovations throughout history have found ways to persist and evolve despite opposition.

The parallels between the Templars’ financial innovations and the current crypto revolution are striking. Both represent paradigm shifts in how value is transferred and stored, and both faced significant pushback from established powers.

However, the decentralized nature of blockchain technology provides a resilience that the Templars could not achieve, making it more difficult for any single authority to suppress these innovations. By creating decentralized systems for content creation, identity management, and value exchange, Koii is continuing this historical tradition of challenging centralized control over critical systems.

Reclaiming Digital Sovereignty with Koii

We must move beyond the false promises of centralized platforms and the limitations of current blockchain solutions. Koii offers a vision of a truly decentralized digital future, where autonomy is not just a lofty ideal, but a lived reality. Through its innovative approaches to content creation, identity management, and value exchange, Koii is paving the way for individuals to reclaim control over their digital lives.

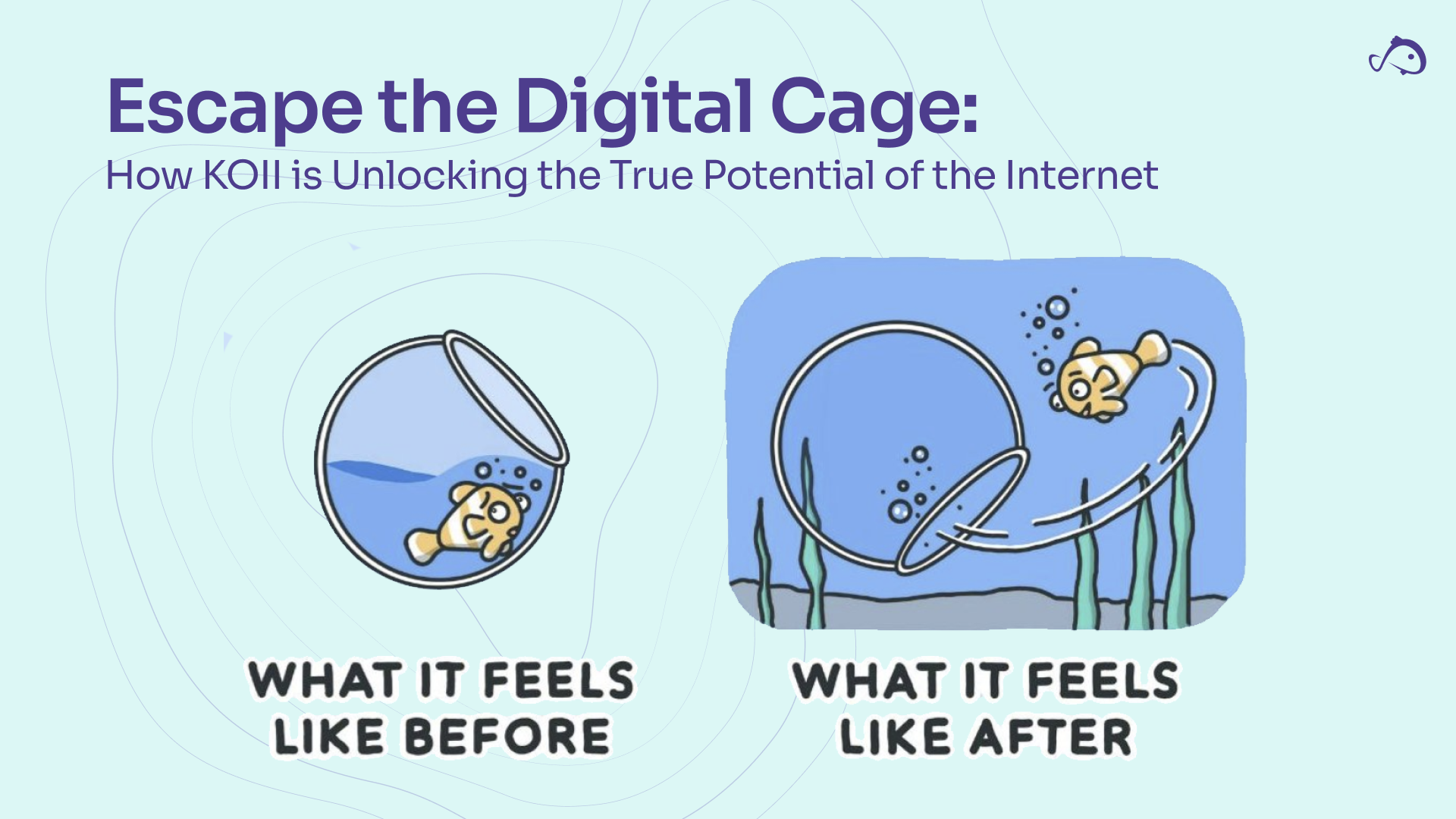

Escape the Digital Cage: How KOII is Unlocking the True Potential of the Internet

Escape the Digital Cage: How KOII is Unlocking the True Potential of the Internet